+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Please share with Shareable! Click here to support our coverage of the real sharing economy.

What role do complementary currencies play in alleviating poverty, creating income equality, and building sustainable communities? According to John Boik PhD, a vital one. Founder of the Principled Societies Project and author of the book Economic Direct Democracy: A Framework to End Poverty and Maximize Well-Being, Boik designed a multi-faceted framework for local democratic systems of which a complementary currency is a key element. A computer simulation model that describes the book’s proposed local-national currency system saw median and mean take-home family income more than double, income inequality nearly eliminated, and the unemployment rate drop to 1 percent over the 28-year simulation period.

Shareable connected with Boik to learn more about his framework, the role that the complementary currency plays in it, and what needs to happen for real-world application of the model.

Shareable: Your simulation model has produced impressive results, including a reduction of income inequality. What inspired you to develop the model?

John Boik: The model serves several purposes, but let me start with the most basic, and some background. I developed it while I was writing Economic Direct Democracy. The book proposes an economic system, or more broadly, an economic-financial-business-social welfare system that, true to the book’s subtitle, is intended to end local poverty and empower a community to maximize its well-being.

The proposed system is called the Local Economic Direct Democracy Association (LEDDA) framework. Local here refers to a city, county, or multicounty region. Think city and surrounding suburbs and rural area, or a smaller town and surrounding rural area. The framework is synonymous with LEDDA economic direct democracy, a local economic system infused with democracy. This form of economic democracy uses money as a voting tool.

Every economic system functions as a decision-making system. A society uses an economic system to decide, for example, how and when resources will be used, and for who’s benefit. To ensure that the decision-making process in the LEDDA framework is democratic—that votes are distributed fairly—the LEDDA framework increases and equalizes member incomes over time.

I realize that this is a pretty bold statement. How do incomes for the poor increase? Where does the money come from? And how are families with high incomes affected? It would have been far easier for me to answer these and related questions by oral argument—to simply describe in words how currency is supposed to flow in a LEDDA economy. But I couldn’t do that in good conscience. Even though most of the book was written before I began the modeling process, too many questions were still present in my mind. I had to convince myself that the flows made logical sense. To do that, I needed a model.

Did the book and LEDDA framework change because of the model?

Yes, absolutely. Modeling is a process. That is, a scientist usually has an incomplete understanding of a system under study when modeling begins. This is especially true when a new product is being developed, such as a spacecraft, or economic system. Part of the reason for modeling is to learn about and improve a system.

The model focuses on the Token Exchange System (TES), the local-national currency system of the LEDDA framework. It is just one of the framework’s many elements. A LEDDA—which is a membership-based community benefit association—creates an electronic currency, called the token, via a debt-free process. The token circulates locally alongside the national currency. The model simulates token and dollar flows in an average-sized virtual US county.

When I started the modeling process, I had several aims in mind. First, I wanted incomes to increase in the modeled world for all member families. Income increases are important, as few families would want to participate in a LEDDA if they lost money or merely broke even. On the other hand, many might be interested in joining if their incomes were to rise. I am speaking here of inflation-adjusted, pre-tax, take-home income.

Second, I wanted incomes to rise and equalize for all members, regardless of employment status. As mentioned already, a high degree of income equality is necessary for proper function of LEDDA economic direct democracy. Money is used as a voting tool. In a political democracy, employed people should not receive more votes than the unemployed. The same is true in economic direct democracy.

The mechanisms to achieve these aims were worked out during the modeling process. I don’t have room here to describe the details—they’re available in the paper—but I can say that incomes for low-and mid-income families rise steadily through the years. Higher-earning families can also benefit through a direct income gain in the form of an incentive bonus, paid in tokens. The system is designed so that every member family sees an income gain over baseline (initial) conditions in every year. Thus, one can say that a LEDDA pays people to participate.

John Boik discusses the details of the LEDDA framework

How does your economic model compare to others? Is it standard?

It might surprise some people to learn how the economy is usually modeled. From a mathematical perspective, the economy of a nation, state, or city can and probably should be viewed as a complex adaptive system. That is, an economy comprises a large number of agents (e.g., persons, businesses, nonprofits, governments) that interact in multiple ways. As a whole, an economy learns from past experience and adapts to new conditions. And it shows similarity when viewed at different scales (a small business and large business share common traits, for example). Last, it self-organizes—it spontaneously produces large-scale patterns of order due to the interactions of the individual agents.

Self-organization, which is a modern term from the field of artificial intelligence, nicely describes the “invisible hand” that Adam Smith—the father of modern economics—spoke of in the 1700s. Smith said that individuals acting in their own best interests produce a type of constructive order within the larger economy. The trouble is, when it comes to models, most economists emphasize the order part and downplay the rest of complex system behavior.

The vast majority of economic models in use today are not well-suited for studying complex adaptive systems. Instead, economists use simple models that capture linear behavior near some equilibrium point. These models typically lump all individuals into one aggregate person. Thus, they are also not well-suited to examining income inequality. And most exclude the financial system, which is viewed as neutral.

As we all know post-2008, economies do not necessarily remain near equilibrium. They can, at times, stray far from “normal.” Indeed, the fact that multiple economies have experienced hyperinflation in the last century, and that multiple human civilizations, and their economies, have collapsed in the historic past, should be a good indicator that “normal” behavior cannot be assumed. We also know that the financial system does impact the rest of the economy—it was the seed of the 2008 global crisis. And we know post-Occupy Wall Street and post-Thomas Piketty that income inequality is a big problem that must be studied and addressed.

Models matter. They inform public opinion and guide policy. Over-reliance on standard models was one reason that nearly all economists failed to see the 2008 crises coming.

A small but growing number of economists and social scientists are now advocating for greater use of agent-based models and other tools of complexity science when studying economies. Among them, for example, is J. Doyne Farmer of the Santa Fe Institute. The simulation model that I developed is agent-based.

What does agent-based mean, and why is your model referred to as “first-in-class?”

Agent-based simply means that the model simulates the interactions of agents. In my case, the agents are individuals who interact with the set of aggregate businesses, an aggregate government, and so on. It’s a highly simplified model, but is still is able to capture changes in the distribution of family income, among other things.

The model is also stock-flow consistent, which means that the movement and storage of currency is fully tracked. This is the type of accounting you do with your checkbook at home. A dollar spent by one agent is recorded as a dollar received by another, for example.

Last, the model is semi-realistic in that it starts from conditions that resemble real ones. Starting incomes are derived from US Census data, for instance, and tax rates resemble real tax rates.

The model is unique in that it is the first-ever agent-based, stock-flow-consistent, semi-realistic model of a local-national currency system. As such, it paves a new path—it suggests a new approach to understand, describe, and assess local and local-national currency systems.

I should point out that any type of modeling of local or local-national currency systems is rare. Only a handful of models have been developed so far. By my count, of these only two are simulation models. Mine, the third, is substantially more sophisticated.

The simulation tracks currency flows in a US county of population 100,000 over a 28-year period. What are the most striking changes that you observe?

Before answering, let me emphasize that the model is illustrative, not predictive. It describes how the dollar and token are intended to flow. Nonetheless, the model and its results are important. First, the model provides an explanation of theTES. Second, because the model is stock-flow consistent, it rules out certain logical errors in system design. Currency does not magically appear or disappear. One can think of the model as first-pass, low-resolution; it sets the stage for more sophisticated, higher-resolution models to follow.

That said, the outcomes of the model are as bold as the aims. I intended to create a model in which: (a) all member families see an income increase over baseline in all years; (b) incomes equalize as they rise; and (c) full employment is achieved. What is most surprising, perhaps, is that these aims can be achieved in a logical and coherent fashion. That is, the results suggest that such an economic system is not impossible.

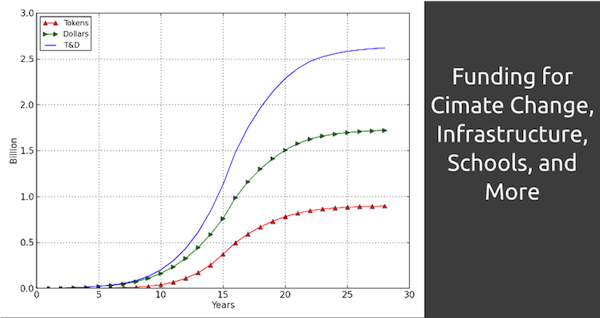

To give some idea of impact, by the end of the 28-year simulation 90 percent of the population in the virtual county has joined the LEDDA. The only families that do not join are those who earned in the top 10 percent of baseline income—about $104,000 and above. The participation rate reaches 90 percent because the system substantially increases incomes for all families below the 90th percentile of baseline income. Incomes for non-members are not directly affected. (Note that in a real LEDDA, members would likely come from all income brackets. Every person would be welcomed.)

By Year 28, all member families receive an inflation-adjusted, take-home, pre-tax income of about 107,000 tokens plus dollars. (The token and dollar are assumed to have equal purchasing power.) Even families that have unemployed or otherwise non-working adults receive this income. The median and mean member family incomes increase by more than 260 percent from baseline.

Further, full employment (assumed to be 1 percent unemployment) is achieved by Year 10 for the membership and Year 15 for the county as a whole.

Last, by Year 28 the LEDDA channels about 2.6 billion tokens plus dollars to local business and nonprofit organizations annually. Nonprofits here could include schools, public service agencies, research centers, charities, and so on.

To provide context for the results, look at the real economy. The mean inflation-adjusted income for families earning below about the 60th percentile has remained nearly flat for the past 40 years, while incomes for the top 1 percent have skyrocketed. More details are in my book.

All elements of the LEDDA framework function in some way to further democracy and to empower a community to maximize well-being.

Community currencies have been around for a while. How is the token system different from existing community currency systems?

Community currency systems come in a wide range of sizes and designs. The TES displays some similarities with current or historical community currencies systems, but taken as a whole it is unique. The biggest difference is that it is one part of the larger LEDDA framework, which implements LEDDA economic direct democracy. All elements of the LEDDA framework function in some way to further democracy and to empower a community to maximize well-being.

But besides this, a TES uses novel mechanisms to control and manage the flows of local and national currency. A TES uses constructs such as Wage Options, income targets, token share of income targets, and earmarks. See the paper for a complete description. It also offers interest-free loans in both tokens and national currency, uses demurrage to control the flow of tokens, and has a profit-neutral financial system that resembles participatory budgeting. That system funds local for-profit and nonprofit organizations, as well as hybrid businesses organized according to a unique socially responsible model that is a cross between a for-profit and nonprofit.

A LEDDA framework is introduced as a fundamentally new economic system, yet it layers on top of an existing local economy, using both tokens and national currency. How does a LEDDA interact with existing systems? And why is it important that the token is a parallel currency?

The LEDDA framework is a local, parallel system, and the token circulates with the dollar or other national currency. It is designed as such partly because this is seen as the most viable means to implementation. Even if a proposed system was an amazing, perfect solution to humanity’s problems, it would never be implemented if doing so required abrupt replacement of existing systems. No government is going to toss out its existing economic system in favor of a new one, short of a fierce political fight, if not revolution. Abrupt replacement is not politically viable, and the unknowns for any real alternative would be too great. Further, no nation, or city, is an island. Each interacts and engages with others through trade. A dual currency system is amenable to this.

It’s my belief that the most practical path forward is to develop and test a parallel, local system that complements and competes with existing systems. That way, people have a choice. Individuals and organizations can become a member or not. And the membership grows and LEDDAs spread only if the system works properly and provides real benefits.

There are other advantages for keeping the system local. A local system can be more responsive to a community’s needs. And it can help build trust and social bonds. Further, it decentralizes economic power and allows a community to express its own unique flavor.

How do LEDDAs interact with each other to create a network of local economies?

LEDDA members are encouraged to purchase from local organizations, and LEDDA organizations are encouraged to produce goods and services for the local community. But trade and other forms of cooperation with the outside world, and especially with other LEDDAs, is critical—the success of a LEDDA and the successful spread of the LEDDA framework depend on it.

A LEDDA governs itself via an online form of (hybrid) direct democracy. And all LEDDAs are networked within a global association, which also governs itself via online direct democracy. The purpose of the association is to foster trade and cooperation, to set standards, to promote and improve the LEDDA framework, and to benefit the combined membership and the global public.

As just one example of cooperation, the LEDDA framework includes an intellectual property pool. The idea is to foster the free flow of ideas and information, and to stimulate and speed scientific discovery. IP pools could span multiple LEDDAs, or ideally all LEDDAs globally. The larger the pool, the greater its power and impact.

As another example, the framework encourages formation of distributive enterprises, transparent socially responsible businesses that seek their own open replication in multiple regions. For example, a business in one LEDDA that produces electronic parts might make its designs and procedures public so as to encourage formation of similar businesses in other LEDDAs. By adopting an open model, the original business might receive many benefits, including customer loyalty and assistance from the public in improving its methods. New open-franchise models that span LEDDAs could develop in keeping with the distributive enterprise concept.

Do you foresee that the LEDDA framework could spread to all nations?

The framework is designed to spread. It is intended to be self-sustaining, self-promoting, and self-replicating. But political conditions and legal codes will no doubt influence whether the system is allowed in any given country. In the United States, Europe, and many other areas, it appears that the LEDDA framework is legal as it stands; no new laws will need to be passed prior to implementation. Of course, the framework is complex, and legal issues do exist. But these are not seen as prohibitive.

Economic conditions might also influence the spread of LEDDAs in a nation. The framework will be flexible enough so that it can be adapted to local conditions. And it should be functional even in developing or otherwise emerging nations. But implementing a LEDDA in an area of extreme poverty might pose serious challenges. Efforts will be made to make the framework applicable for as large a range of conditions as possible. Cultural conditions in an area or nation might also influence LEDDA spread and success.

How are new LEDDAs created?

Keep in mind that the LEDDA framework is still theoretical. Much work remains to develop and test the framework before it can be implemented. But once development and testing have been completed, local organizers would introduce a LEDDA in their community. They would likely receive help from existing LEDDAs and the association of LEDDAs.

Starting a new LEDDA is an involved process. A great deal of planning and education is necessary. For one thing, no LEDDA should start operations until computer simulation models adapted to local conditions suggest that the membership of an incipient LEDDA is large and diverse enough to achieve successful token-dollar circulation. These models will be more sophisticated than the one recently published.

To increase the chances of success, organizers of an incipient LEDDA might seek new members, including individuals and existing for-profit and nonprofit organizations, and might seek the development of new businesses that would benefit token-dollar circulation.

Software infrastructure will also need to be implemented, and trainings held for potential members.

What needs to happen now to set your idea and model into motion? What are some of the biggest challenges?

In October, 2014, Lorenzo Fioramonti, director of the Centre for the Study of Governance Innovation (GovInn), at the University of Pretoria, South Africa, and I co-founded the LEDDA Partnership. This is intended to become a diverse, international association of academic, civil society, government, business, and philanthropy groups tasked with the job of ushering the LEDDA framework through the development and pilot trial phases. Public input and support will also be invited. Likely locations for pilot trials include cities in the United States and South Africa.

In October, 2014, Lorenzo Fioramonti, director of the Centre for the Study of Governance Innovation (GovInn), at the University of Pretoria, South Africa, and I co-founded the LEDDA Partnership. This is intended to become a diverse, international association of academic, civil society, government, business, and philanthropy groups tasked with the job of ushering the LEDDA framework through the development and pilot trial phases. Public input and support will also be invited. Likely locations for pilot trials include cities in the United States and South Africa.

The work of the partnership is expected to span a 10-year period and cost $70 million in total. It is a focused and bold attempt to build new economic foundations for 21st century society. A strategic plan for the partnership has been posted.

The first step is to build organizational infrastructure, and to this end we invite support by individuals, businesses, and foundations. Once the organizational infrastructure is in place and funding secured, program efforts will begin. Work will span a wide range of fields, including education, ecology, labor, climate, poverty, public health, economics, finance, business, agriculture, sociology, law, computer science, urban planning, media, literature, public administration, political science, and international relations. Interested parties are encouraged to contact us for details.

What’s the big picture, take-home message around the framework?

The take-home message is that humans are talented and creative. We are fully capable of developing and implementing an economic system that better serves our needs, is robust and sustainable, encourages cooperation rather than selfishness, and builds true wealth—social, economic, and environmental well-being—for all participants. The biggest step is to choose this goal and the rest will naturally follow.

##

Top photo: Peter-Ashley Jackson (CC). Follow @CatJohnson on Twitter