In my last post, I gave readers an introduction to peer-to-peer lending (also referred to as p2p lending or social lending). Today, we are going to assume the investor is ready to get started — so here are some guidelines for all new investors to think about as they take the plunge into p2p lending. These guidelines apply to investors in either Lending Club or Prosper, the two main players in the industry.

- Do you qualify?

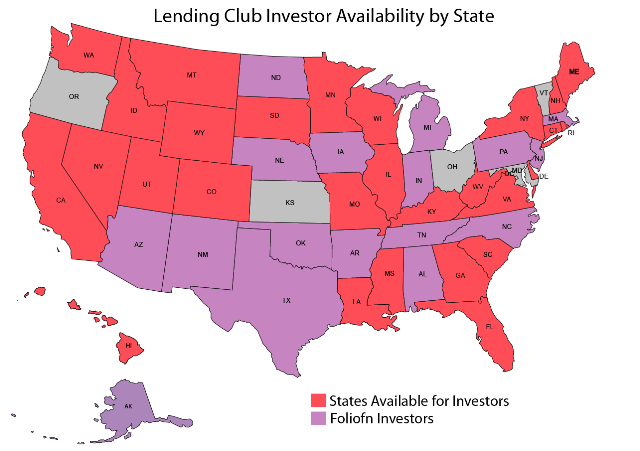

Before you get your hopes up, you should check to see if your state allows p2p lending. Currently, Lending Club allows 29 states on their retail platform and Prosper allows 28 states. Some states that allow p2p lending have some specific requirements. There are also some income/net worth requirements and both sites recommend that no investor have more than 10 percent of their net worth invested in p2p lending. While neither site will audit anyone’s tax returns or financial statements, these requirements are designed to protect the investor. - Decide on your risk tolerance.

If the thought of a borrower defaulting on a loan that you helped fund is abhorrent to you, then I would suggest you stick with the lowest risk borrowers. The grade A borrowers are the most creditworthy borrowers (on Prosper they are called grade AA) and, while they occasionally default, these borrowers are considered the safest investments. Your returns will also be capped because you are investing in loans with the lowest interest rates — typically less than 8 percent. So, if you have a higher risk tolerance, then you should focus on a broader range of borrowers where there is the possibility of earning higher returns. But I encourage new investors not to go for a home run by only investing in the high interest loans. - The most important word: diversification.

If you take nothing else from this article other than remember and implement this point, you will be well on your way to decent returns. The minimum investment per loan at both Lending Club and Prosper is $25. Use this minimum as your guide. Unless you are investing more than $5,000 you should not even think of investing more than $25 per loan. Even if you invest in only A-grade loans, you will likely get some defaults and you want the impact of these defaults to be minimal. If you have 200 notes and one borrower defaults right away, you have lost 0.5 percent of your investment; with 20 different notes you will have lost 5 percent. A 0.5 percent loss is far easier to recover from than a 5 percent loss.

- Start small — but not too small.

The minimum initial investment at both Lending Club and Prosper is just $25. But, as I just demonstrated in the previous point, you will not be very diversified if you invest a very small amount of money. I always like to see investors start with $2,500 as a minimum because you can invest in 100 notes this way, which will be a fairly well-diversified portfolio. If you only have $500 to invest, then I recommend sticking with the low-risk borrowers, grade A and B on Lending Club and AA and A on Prosper. This will minimize your likelihood of defaults. - Decide on some simple filters.

When you go to invest on Lending Club or Prosper, there are hundreds of loans to choose from. If you want to read the details of every loan, it can be overwhelming. It is far better to filter the loans down to a more manageable number. The first filter you should consider is loan grade. Other popular filters are number of inquiries, credit card utilization percentage, employment length, and number of delinquencies. You can decide on your own filters by doing your own research on third party statistics sites Nickel Steamroller or Lendstats or you can invest like I do. I provide a complete list of the p2p loan filters I am using right now. Keep in mind, I have been investing since 2009 and I am an aggressive investor — these filters may not be suitable for everyone. - Consider automating your investing.

Once you have set up some filters on Lending Club or Prosper, you can save these for your next visit. Prosper has a completely hands-off investing strategy called Automated Quick Invest where you can take your saved filters and set up an automated plan based on this criteria so you never need to login. Lending Club also allows you to save your filters, but you do need to login every time you want to invest. Both platforms offer a “do it for you” service for large investors — Lending Club PRIME and Prosper Premier — but you need $25,000 to qualify.

- Manage your expectations.

It usually takes about 30-45 days after you start investing to receive your first return numbers. These initial numbers can seem very impressive. Even if you are investing in just A and B grade loans, your returns can start out at more than 10 percent. At this stage, some investors can get very excited and assume that these are the returns they will receive going forward. But defaults are a part of p2p lending and even just a small number of defaults can bring your return numbers down significantly. Expect to have your return numbers drop anywhere from 2-5 percent by the end of your first year.

There is a reason p2p lending is growing at well over 100 percent a year. Thousands of investors are receiving excellent returns in what is a low volatility investment. Many investors also like the idea of investing in individuals rather than in big banks or the stock market. Whatever your reason, I think p2p lending is an investment well worth consideration. And, if you follow the steps outlined here, you will have a good chance of earning excellent returns, too.

###

Peter Renton is the editor and publisher of the Social Lending Network, a blog dedicated to teaching people about peer-to-peer lending.