In preparation for Shareable’s Fall 2019 series on sharing land, I created a timeline to get a better sense of the sweep and sequence of U.S. land use and housing policy (feel free to scroll down to the actual timeline below). I felt like I had only a few pieces of a big puzzle and a faint notion when these pieces were laid down. Luckily, some fantastic resources have emerged recently to consult like Richard Rothstein’s acclaimed book, “The Color of Law,” and Jessica Trounstine’s, “Segregation by Design.”

Still, this was a challenging task. The history of U.S. housing policy is obscured by the surprisingly uncoordinated action of multiple levels of government taken over a century. Also, other developments often not lumped in with housing policy had a big influence on housing, like the interstate highway system and Fannie Mae, which were enablers of vast suburbs. I thought pulling these events together into one stream of events would be helpful.

I did gain insight, but a few caveats are in order. My research isn’t academic quality or comprehensive. It relies on online sources including Wikipedia. Some entries include my own assessments of events rather than analyses of others. With these caveats in mind, I invite you to engage with the timeline critically, give feedback, and use it as a starting point for your own projects. I also offer you a few observations I gleaned from researching this history, which was an eye-opening labor of love for this raised-in-the-‘burbs white dude:

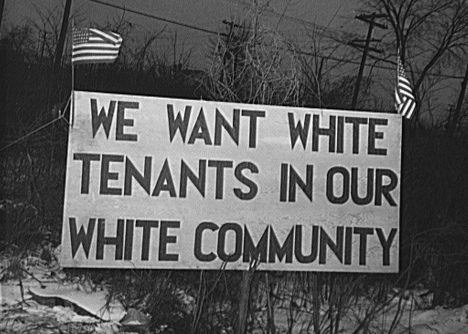

- Racism played a starring role in U.S. housing policy. That policy had five main motivations: to keep blacks out of white neighborhoods, court white voters (though New Deal officials acted on their own biases too), stabilize the workforce through mortgage debt, stimulate the economy, and act as a bulwark against communism. The last three motivations waxed and waned, but the racist element is deep and persistent. I came to see the American landscape as tragically shaped by hate. There may not be a clearer example of structural racism and its huge cost to blacks and American society. The U.S. is one of the most unequal and resource intensive societies in the developed world. Our massive, racist commitment to single family housing is a big reason for this. It turns out that hate is extremely expensive. There’s a lesson in this for us today — that one of the best investments the U.S. can make is in a more thoroughly integrated society. As other developed nations have done, the U.S. can use housing to help achieve this.

- Land use and housing policy evolved through five major stages since the beginning of the 20th century:

-

- Pre-Great Depression, when local governments played the larger role.

- The New Deal era, when the federal government created the modern framework for housing in America.

- The post-war era, when that framework was dramatically scaled up.

- The post-Civil Rights era, when many of the racist policies were addressed, but with mixed results.

- The post-subprime crisis era, when minorities experienced huge setbacks in homeownership due to predatory lending and a subsequent epidemic of foreclosures. The losses of this most recent era, along with the fact that segregation stubbornly persists, suggest that gains in minority housing since the Civil Rights movement have been compromised and are probably more modest than most Americans think. This is also the era when “The Great Inversion” picks up steam, increasing minority displacement in America’s largest cities.

- We’re at the beginning of a sixth stage where a chronic shortage of affordable housing will catalyze major policy changes. If past is prologue, then it’s likely the results will be mixed at best. This is a running theme in the timeline. For instance, when restrictive covenants were outlawed, that led to increased blockbusting, which hurt both blacks and whites. Another example is when discriminatory lending was outlawed. This expanded predatory lending. Even when the federal government intervenes to protect or house more people, the most vulnerable still frequently suffer. This is an especially scary prospect as cities and states begin increasing density in single family neighborhoods, a trend that began in Minneapolis late last year. Unless parallel inclusionary measures are taken, upzoning single family areas could simply be another bonanza for homeowners, investors, and developers. It also won’t make things better for blacks and other minorities, who deserve justice. The U.S. will need to fundamentally change its housing philosophy and strategy to avoid this outcome. This means stop treating housing as a commodity and a financial investment and start treating it as a right and social investment. It also means that the U.S. shouldn’t expect private developers to serve the low-end of the market when there’s no chance to profit. Like many developed countries, U.S. governments should do whatever is necessary to ensure everyone has access to high quality housing. That should include increasing emphasis on commons-based (housing cooperatives, community land trusts, etc.) and public housing strategies.

U.S. Housing Policy Timeline 1865-2019

1865: General Tecumseh Sherman issues order to redistribute to each freed slave up to 40 acres of a swath of formerly white-owned land that stretched across three states. Known popularly as “40 acres and a mule,” this post-Civil War policy lasts less than a year.

Source: The Truth Behind ’40 Acres and a Mule’

1877:

Federal protection of blacks in the South ends. This paves the way for Jim Crow era, which starts over a decade later. Oppressive conditions spur The Great Migration, a near century-long migration north and west by six million blacks. This migration is a prime catalyst for the development of racially motivated zoning and housing policy by local, state, and federal governments that unfolds in stages over the next century.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 39, 1st paragraph; (2) The African-American Migration Story

1908: Los Angeles City Council passes first municipal zoning ordinance in the U.S. It separates just a portion of L.A. into residential and industrial districts. This is done primarily to protect residential communities from nuisances and hazards of certain industries, but it has a racial component. It lumps laundries, mostly run by Chinese entrepreneurs, into the industrial category to keep the Chinese out of white neighborhoods.

Source: Zoning in the United States

1910: Baltimore, Maryland adopts first racial zoning code. Blacks aren’t allowed to live in white neighborhoods and vice versa.

Source: “Color of Law: A Forgotten History of How Our Government Segregated America,” page 44, 3rd paragraph.

1913: After an amendment to the constitution, a new income tax is enacted that includes a deduction on interest paid on loans. Intended for business interests, the deduction becomes a huge boon to homebuyers when home loans begin replacing cash purchases a few decades later. The home mortgage interest deduction becomes a significant subsidy of homeownership that primarily benefits whites, who historically have had the highest levels of homeownership.

Sources: (1) Who Needs the Mortgage-Interest Deduction? (2) The History of the Mortgage Interest Deduction

1916: New York City adopts the first citywide zoning ordinance in the U.S. Unlike L.A.’s earlier ordinance, it applies to all of NYC. It restricts building heights to ensure adequate light and air at street level and separates the city into residential, retail and industrial zones to reduce nuisances and health hazards, among other things. It achieves a lasting reduction in density in Manhattan, which is a third less crowded in 2010 than a century earlier.

Sources: (1) 1916 Zoning Resolution; (2) Zoning Arrived 100 Years Ago. It Changed New York City Forever.

1917:

Buchanan v. Warley: Supreme Court rules that a zoning ordinance in Louisville, Kentucky prohibiting the sale of property in a white neighborhood to black buyer and vice versa is unconstitutional. Similar ordinances exist in other cities. While the ruling is widely ignored, it leads to the development of single family zoning (one house and family per lot), which has the effect of segregating races without mentioning race.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 45, 3rd paragraph; (2) Buchanan v. Warley

1917-1921: The federal government promotes ownership of single family housing to white Americans to stimulate the economy and create a bulwark against communism in the wake of the 1917 Russian revolution. “Federal promotion of homeownership became inseparable from a policy of racial segregation,” writes Richard Rothstein, author of “Color of Law.”

Source: “Color of Law: A Forgotten History of How Our Government Segregated America,” page 63, 1st paragraph.

1919: St. Louis adopts an exclusionary zoning ordinance, which prevents anything but detached single-family homes in certain neighborhoods — intentionally excluding black and other residents by pricing them out. There’s no mention of race in the ordinance, making it appear non-discriminatory and constitutional. This is an early example of what becomes the nearly universal model of residential zoning across the U.S.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 49, 3rd paragraph; (2) Exclusionary zoning

1924: The U.S. Commerce Department publishes “The Standard State Zoning Enabling Act” (SZEA), a model law for U.S. states to promote zoning regulations. Fifty five thousand copies are sold, and 19 states pass laws based on it. The advisory committee for the publication is composed of outspoken segregationists. SZEA and the Standard City Planning Act of 1927 lay the basic foundations for land use controls in the U.S.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 51, 1st paragraph; (2) Standard State Zoning Enabling Act- Wikipedia; (3) Standard State Zoning Enabling Act

1926: Euclid v. Ambler Realty: The U.S. Supreme Court rules that municipal zoning regulations in Euclid, Ohio are constitutional. This landmark case paves the way for municipal control of zoning. The policy’s exclusionary aspects help drive rapid adoption and it soon becomes standard. Many U.S. cities eventually zone 75 percent or more of their residential land for single family homes, including Los Angeles, San Francisco, San Jose, Seattle, Portland, Minneapolis, and Charlotte. The academic research in the recent book, “Segregation by Design: Local Politics and Inequality in American Cities,” suggests exclusionary zoning makes segregation worse and contributes to city decisions to under fund development (parks, schools, etc.) and put more nuisances (garbage dumps, etc.) in black communities while directing more resources to white communities. These actions contribute to glaring disparities in wealth, health, education, and policing between black and white communities.

Sources: (1) “Segregation by Design: Local Politics and Inequality in American Cities;” (2) Village of Euclid v. Ambler Realty Co.; (3) Cities Start to Question an American Ideal: A House With a Yard on Every Lot

1934: Federal Housing Administration (FHA) is created to boost home ownership during The Great Depression. The FHA insures home mortgages, but only for houses well inside the boundaries of white neighborhoods. This leads to the industry standard practice of redlining, which systematically withholds credit from homebuyers in black neighborhoods. In addition, the FHA favors loans for new suburban construction over older urban properties, thus simultaneously contributing to urban decay and the growth of white suburbia.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 64, 4th paragraph; (2) Redlining

1938: Congress creates the Federal National Mortgage Association (Fannie Mae) to boost homeownership levels by making low-cost loans widely available. Fannie Mae does this primarily by buying mortgages from local banks and securitizing them, thus freeing banks nationwide to dramatically increase their mortgage lending. FHA guidelines severely limit black access to mortgages. Only two percent of the $120 billion in new housing subsidized by the federal government between 1934 and 1962 goes to nonwhites. The FHA and Fannie Mae provide the template for the modern U.S. mortgage market. In the process, they institutionalize discrimination that persists after discriminatory lending is outlawed in 1968 and subsidizes homeownership and wealth building for millions of white Americans while locking out blacks and other minorities.

Sources: (1) Fannie Mae; (2) Go Deeper: Where Race Lives

1944: The GI Bill promises many benefits for returning service people, including low-interest home loans, but the program’s structure prevent blacks from fully accessing these benefits. For instance, the Veterans Administration (VA) begins insuring home loans to veterans after the war, but adopts FHA’s discriminatory guidelines. Most blacks, including black veterans, are left out of the post-war housing boom, a key source of wealth for white middle-class families.

Source: How the GI Bill’s Promise Was Denied to a Million Black WWII Veterans

1947: Home sales begin in Levittown, New York, the archetype of the postwar suburb and a potent symbol of the American Dream. Levittown is the first mass produced, large-scale suburban development and meant to provide affordable housing to veterans during a severe postwar housing shortage. Financing for the development is backed by the FHA and VA, which prevent home sales to blacks. Lease agreements signed by the first residents who have an option to buy includes a racially restrictive covenant and applications from all blacks including veterans are refused. Levittown sets the pattern for the post-war suburban housing boom across the U.S. The combination of tax incentives, single-family zoning, widely available financing, and home building innovations combine to fuel an unprecedented growth of suburbia and its attendant ills: racial segregation, inequality, social isolation, car dependency, hyperconsumption, and eventually climate change.

Sources: (1) Levittown, New York- Wikipedia; (2) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 70.

1948: The U.S. Supreme Court’s Shelley v. Kraemer decision prevents court enforcement of racially restrictive covenants included in deeds. Widely used for decades, these covenants prevent white homeowners from selling to blacks and other minorities. They were also required for FHA-insured loans. They are used to keep minorities out of white neighborhoods, as deeds with these covenants “run with the land” (are passed down through successive owners). Many deeds with these covenants still exist today though they aren’t legally enforceable. While the ruling represents progress, it also leads to much more blockbusting by unscrupulous real estate operators. This hurts both black and white homeowners.

Sources: (1) “Color of Law: A Forgotten History of How Our Government Segregated America,” page 85, 1st paragraph; (2) Shelley v. Kraemer- Wikipedia; (3) Blockbusting- Wikipedia; (4) A Requiem for Blockbusting: Law, Economics, and Race-Based Real Estate Speculation; (5) Racially Restrictive Covenants in the United States: A Call to Action.

1949: The American Housing Act of 1949 greatly expands the federal government’s role in housing. It includes significant funding and authorizes the use of eminent domain to clear slums. By 1974, 2,100 urban renewal projects covering 57,000 acres costing about $53 billion (in 2009 dollars) have been completed. In the process, 300,000 families are forced to move, just over half of them black.

Sources: The Controversial Legacy of Slum Clearance

1956: The National Interstate and Defense Highways Act funds the construction of the Interstate Highway System with $25 billion for 10 years, the largest public works project in U.S. history. This initiative accelerates and subsidizes suburbanization, disproportionately benefiting white middle-class families. It also leads to the demolition of what are deemed “blighted” urban areas, displacing and further impoverishing communities of color.

Sources: (1) Federal Aid Highway Act of 1956- Wikipedia; (2) Did Highways Cause Suburbanization?; (3) 40 Years of the US Interstate Highway System: An Analysis; (4) The Racist Legacy of America’s Inner-City Highways; (5) The Role of Highways in American Poverty

1968: Fair Housing Act (Title VIII of the Civil Rights Act of 1968) makes it unlawful to “refuse to sell, rent to, or negotiate with any person because of that person’s inclusion in a protected class.” While the act represents progress, dramatic housing disparities persist for a number of reasons: inconsistent enforcement, the lingering impacts of a past discriminatory housing policy including the huge wealth gap between blacks and whites, implicit bias, and predatory lending, which the act inadvertently makes possible on a much bigger scale. In 2018, 43.6 percent of black households own their homes versus 73.6 percent of white households.

Sources: (1) Civil Rights Act of 1968- Wikipedia; (2) Homeownership Rates by Race and Ethnicity; (3) Black and White Homeownership Rate Gap Has Widened Since 1900

1970:

Suburban housing reaches a plurality and thus the U.S. becomes a segregated, suburban society mostly through the actions of local, state, and federal governments. By 2010, more than half the U.S. population lived in suburbs.

Sources: (1) “Segregation by Design: Local Politics and Inequality in American Cities,” page 8, 3rd paragraph; (2) The US has become a nation of suburbs

1977: The Community Reinvestment Act is passed to increase lending in low and moderate income areas and discourage redlining. It’s unclear that the act has its intended effect due to numerous studies with conflicting results.

Source: Wikipedia

1988: Investigative reporter Bill Dedman wins the Pulitzer Prize for his series “The Color of Money,” which uses federal mortgage data to show that lenders nationwide reject black loan applicants at twice the rate of whites — and that high-income blacks are rejected at the same rate as low-income whites. White middle-income neighborhoods get four times as many loans as middle-income black areas.

Source: The Color of Money

2007:

The subprime crisis reaches a peak. An epidemic of irresponsible mortgage lending driven by the high demand for mortgage-backed securities by institutional investors leads to a severe nationwide recession and nearly 10 million Americans losing their homes. Unscrupulous mortgage lenders frequently target vulnerable minority borrowers. As a result, Latinos and blacks experience nearly three times more foreclosure than whites, and decades of progress in their rate of homeownership is wiped out.

Sources: (1) Divided Decade: How the financial crisis changed housing; (2) Subprime Crisis Lingers for Minorities

2012: “The Great Inversion and the Future of the American City” by Alan Ehrenhalt is published. According to Amazon’s blurb, it “reveals how the roles of America’s cities and suburbs are changing places — young adults and affluent retirees are moving in, while immigrants and the less affluent are moving out — and addresses the implications of these shifts for the future of our society.” One result of the inversion is increased displacement of minorities from America’s largest cities.

Sources: (1) The Great Inversion and the Future of the American City; (2) Study: Gentrification And Cultural Displacement Most Intense In America’s Largest Cities, And Absent From Many Others

2018: Minneapolis becomes the first U.S. city to allow multifamily residential housing in all areas previously zoned exclusively for detached single family houses. The plan affects 75 percent of residential land in Minneapolis. It’s intended to undo the barriers that have harmed communities of color, among other goals. Other cities and states start to consider similar measures, though the need to create more housing is often the primary driver. Critics of upzoning residential areas argue that it’s unlikely to help close the racial gap in housing and wealth disparities without parallel inclusionary policies.

Source: Why Minneapolis Just Made Zoning History

2019: Black homeownership hits a 50-year low. The median black family owns just two percent of the wealth of the median white family ($3,600 vs. $180,000). The U.S. is the second largest emitter of CO2 in the world. Its rental housing is the least affordable of 12 advanced countries.

Sources: (1) Black Homeownership Hits A 50-Year Low; (2) How Enriching the 1 Percent Widens the Racial Wealth Divide; (3) Each Country’s Share of CO2 Emissions; (4) U.S. Ranks Poorly in Housing Affordability among Advanced Countries

##

This post is part of our Fall 2019 editorial series on land use and housing policy challenges and solutions. Download our latest free ebook based on this series: “How Racism Shaped the Housing Crisis & What We Can Do About It.”

Or take a look at the other articles in the series:

- Zoned apart: How the US failed to share land but should start today

- How pro-density advocates in Minneapolis took on single-family zoning — and won

- Bringing equity to the forefront of urban planning

- How some cities are looking to in-law units to ease the housing crunch and build more diverse neighborhoods

- Can zoning reform undo “50 years of bad policy?”

- Segregation By Design author expects political battle between fair housing opponents and proponents

- How to ease the US housing crisis? Import strategic policy from abroad

- Cities at turning point: Will upzoning ease housing inequalities or build on zoning’s racist legacy?

- Author Richard Rothstein calls for new civil rights movement to address housing scarcity and injustice

- 8 must read books on US land use and housing policy