Photo credit: Alan Cleaver via Foter.com / CC BY.

At Shared Economy CPA, we’ve had the opportunity to help hundreds of rideshare drivers with their taxes and finances. From this, we’ve seen common issues that individuals face from a tax and financial perspective. For these reasons alone, we’ve teamed with Shareable to provide you with a complete tax and financial tool to help you navigate through the grey.

Understanding Your Status as an Independent Contractor

So, what does Independent Contractor mean? In tax terms, this means that you are self-employed. You are the owner of your business (think of yourself as the Boss AND the Employee). So, when you receive your check from Uber, let’s say, this is not a traditional paycheck and there have been no taxes taken out or withheld on your behalf. It is up to you to take care of your Federal and State taxes, we well as Social Security and Medicare.

See our blog post here for additional information about quarterly estimated income taxes and if you are liable for them.

Deducting Your Business Expenses

As a self-employed driver, you can directly deduct the ordinary and necessary costs of running your business. It is your responsibility to make sure that you take all possible deductions on your yearly income taxes. The most obvious tax-deductible business expenses are the expenses you incur for your car.

There are two ways to take a deduction for the business use of your car:

-

Deduct the actual expenses of using your car for business — including gasoline, oil, repairs, insurance, maintenance, and depreciation or lease payments

-

Take the standard IRS mileage deduction for each business mile driven. For 2015 taxes, the allowed rate is 57.5 cents per mile. For 2016, the IRS has announced the rate is 54 cents per mile.

Since you probably use your vehicle for both personal and business use, you can only deduct the portion of your actual expenses that apply to your business use. Be sure to have good records for all of your deductions; good examples of back-up support for your deductions would be receipts and mileage logs.

Your rideshare company will probably directly deduct the commissions you pay to drive for them right from your check. If you make more than $600 in one year as a driver for any ridesharing company, the companies will send you a 1099 tax form. At the end of the year, you will receive a Form 1099 showing the Gross Earnings of your rideshare business. Be sure to access your personal dashboard and capture all of the expenses that have been charged to you and not shown on your 1099.

Other allowable tax-deductible expenses are:

-

Car washes and interior maintenance

-

Water, snacks, and gum for passengers

-

Tolls and parking fees

-

The portion of your mobile phone that is attributable for your business

Only a licensed tax professional can advise you with certainty as to which deductions you can take legally. If you are unsure as to which deductions are allowed, it is best to consult a qualified CPA for assistance with tax preparation.

What About the Tax Forms?

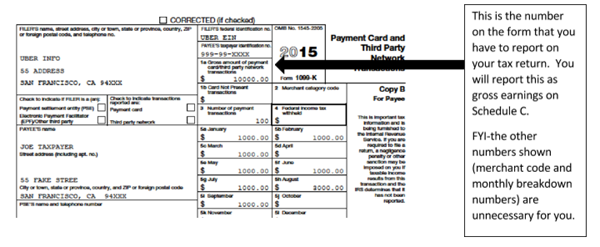

When you receive your 1099 form, it will probably look like this:

Make sure that you keep track of these 1099 forms because you will need them to prepare your tax return.

So, I have received my 1099 form, I have accessed and downloaded my dashboard information showing my driver miles and commissions paid, I have gathered all of my expenses, where do I record this on my tax return?

Most self-employed individuals file form 1040, U.S. Individual Income Tax Return. As a self-employed individual, you must attach Schedule C with your return.

Report Your Earnings and Expenses on Schedule C

You will show your earnings and expenses on Schedule C, which is where you calculate your Net Business Profit. This net number is what you will pay taxes on.

A Schedule C form looks like this:

Report your earnings from any 1099 forms you’ve received on gross receipts (line 1). If you have received more than one 1099 form, sum the totals from your 1099 forms first and record the total of all of the forms on line 1.

Line 9 is where you should record your expenses. You have two options for deducting your expenses as discussed previously. On line 9, enter the total actual expenses of operating your ridesharing business vehicle or you can opt to take the standard mileage rate deduction.

You may take the standard mileage rate deduction for 2015 only if you:

-

Owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or

-

Leased the vehicle and will use the standard mileage rate during the entire lease period.

When you take the standard mileage rate deduction, do not deduct depreciation, rent or lease payments, or your actual operating expenses for your business. If you opt to deduct actual expenses instead of taking the standard mileage rate deduction, enter the portion of expenses for gasoline, oil, repairs, insurance, license plates, maintenance, lease payments, and other fees that you paid for operating your ridesharing business on line 9.

If you opt to deduct actual expenses you must also include depreciation on line 13 and rent or lease payments on line 20a.

Cost-cutting Measures and Ways to Earn More As a Driver

Once you understand how to properly file your taxes as a self-employed independent contractor, it is time to employ some methods to earn more for your ridesharing business. What are some ways that I can make more as an Uber or Lyft? Am I limited to simply driving for cash? The simple answer is NO!

Picking up passengers isn’t the only way to earn money as a ridesharing driver. If you have driven a few times and you have decided that you like the job, get serious about it. Were you offered a signing bonus by your rideshare company? If you have received a signing bonus promotion from Uber or Lyft, make sure that you follow the terms so that you can earn your bonus.

"Pick a system of record keeping and stick to it. It can be an app, pencil and paper, excel log, whatever it is, pick it and stick to it." — Robert R. [San Diego/Lyft]

"Try to find out when its peak driving times and drive during those times. Usually that is downtown on weekend nights." — Cole C. [Chicago/Uber-Lyft]

"Talk to the passengers and be more personable – this will help increase your ratings which will in turn get you more rides more quickly." — Sarah Z. [Indianapolis – Uber]

After all an additional $100 bonus for completing 20 rides with Uber means that you are earning $5 extra for every ride that you give! Offering your driver promo code to new rideshare users is also another way that you can earn more from the same amount of effort. With Uber, passengers earn a free ride credit and you'll get a $5 bonus added to your weekly direct deposits.

You can also opt to refer drivers and you'll receive a bonus once the driver has been hired and has completed a minimum number of rides. If you are a Lyft driver, sometimes Uber offers signing bonuses to current Lyft drivers who sign up for Uber.

Now in terms of cost-cutting, here are a few tips to help you save money:

-

Bring water. Stop buying water and snacks for yourself and bring your own.

-

Buy your own cleaning supplies instead of paying for car washes.

-

Don't invest in gadgets and snacks for customers. You don’t need fancy iPads and refreshments to earn good ratings. If you offer reliable and safe services, that should be enough to get high ratings from your passengers.

The bottom line is that it is you must take the initiative to the most of these opportunities, if you want to increase your earnings beyond simply picking up passengers for rides. Ridesharing companies are always offering bonuses and they are always ways to save money. Think outside of the box!

This is just a general overview of what to expect as a rideshare driver. When you are better prepared, your filing your taxes can be much easier. If you have any other questions, or just need help filing your rideshare taxes, contact us. We are experts in the sharing economy and are here to help.